In part Five of the Trucking in the 21st Century series, we look at how apps are helping trucking companies work more efficiently, profitably, and safely.

Max Fuller, co-founder of U.S. Xpress, is known for being on the leading edge of new trucking technology. After all, it was the logo of the Tennessee-based truckload giant that was emblazoned across the Nikola hydrogen-electric truck prototype unveiled last fall. But Nikola and Tesla aren't the only companies bringing technology into trucking that don't have experience in the industry. Some of the hottest companies attracting venture capital these days deal with trucking apps, especially those that promise to do for trucking what Uber did for passengers.

The problem, Fuller says, is these new entrants into the trucking tech arena "don't know what they don't know" - which makes it tough for those in trucking to figure out what these apps are going to mean to the industry.

And it's not like there aren't already enough apps out there to make your head spin, whether you're a trucking exec like Fuller or an independent owner-operator.

You can find hundreds of trucker-oriented apps for smartphones and other mobile devices on the Google Play Store or Apple Store. Truckers can use apps to find parking, find the lowest priced fuel, bypass weigh stations, find freight - the list seems endless.

The term app is used all the time, but it actually can apply to a few different things: a computer application similar to those used on desktop computers; an application that allows access to a web-based platform (Facebook for instance), or a true mobile app designed specifically for mobile devices. Mobile apps tend to be task-specific - finding a parking spot or checking the weather, for example.

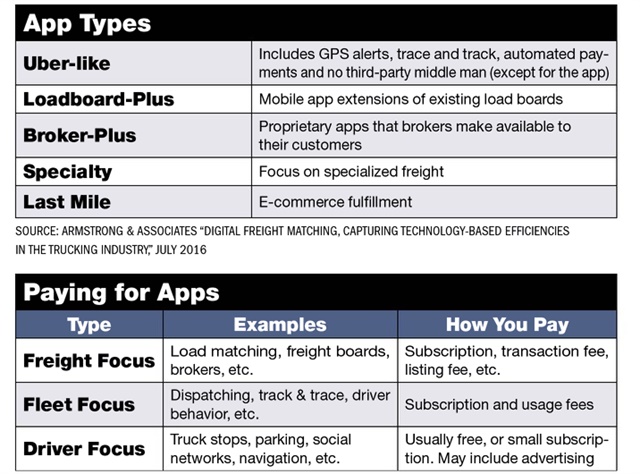

In a recent report, market research firm Frost & Sullivan outlined 70 apps widely used in trucking. It grouped them into three categories:

- Apps focused on the driver (truckstop locators, driving directions, social media, etc.)

- Apps that deal with freight (load matching and load boards, for instance)

- Apps focused on fleet needs (dispatching, tracking and tracing, etc.).

Why are apps the buzz?

Trucking's growing use of mobile devices such as smartphones and tablets is generating a bumper crop of apps, according to Ken Harper, marketing director at DAT Solutions, a longtime player in the freight-matching business.

Most truck drivers - estimates say upward of 90% - carry at least one mobile device. Harper says his company has seen a big shift in mobile usage, reporting that 70-75% of the users of its services now access DAT's website via a mobile device. "Another thing that's relative here is the ratio of truckers to brokers using mobile devices," he says. "We figure anywhere from 80-90% of the smart device users are carriers."

DAT has seen technology morph from its start with truck stop load boards (its original name was Dial-A-Truck), to products available via the internet, to mobile apps. As the company has developed companion apps for its load board products, Harper says, "There has been this seismic shift. We adapted to try to address that."

The same is true for many trucking management system providers. Most large fleets have invested heavily in sophisticated TMS software and mobile communication systems over the years. With the increasing number of small technology providers offering lower-cost web and mobile apps, there has been a corresponding response from the more established vendors. A few examples:

- Users of PeopleNet's onboard communication devices can use the ConnectedDriver app. This companion app to PeopleNet's in-cab device lets drivers stay connected to dispatch and other information when they are away from the truck.

- TMW Systems' new Parts Room app lets parts room workers use a smartphone to conduct inventories, scan bar codes, and other tasks. Much of that work had already been automated, but the ability to use a smartphone reduces costs for carriers, says Alan Tomlinson, director of key accounts. Many shops use handheld computers for inventory work, but these are bulky devices with a proprietary operating system, he explains. "They are expensive and only run apps that are written for that device." Mobile apps offer an attractive alternative. "I totally believe that mobile apps are the wave of the future. Why would companies buy several-thousand-dollar devices when you can switch to these much less expensive alternatives?"

- Fleet management technology and telematics company Zonar recently introduced the GTC (Ground Traffic Control) FieldView app. It works on Android mobile devices and allows managers to keep track of vehicles and drivers in the field even when they're out of the office.

And then there are all the driver-focused apps. For instance, Trucker Path, launched in 2013, now boasts over 450,000 active users, or 30% of all Class 8 truckers, the company says. The app helps truck drivers plan their routes with updated information on parking availability, weigh station statuses, fuel prices, and other locations of interest.

On average, a driver saves around 11 hours per month by using the app, according to CEO Ivan Tsybaev. A key element of the app's success is that it is crowdsourced, he says. "Information is updated by users in real time. This helps deliver the best, most reliable results."

Uber for trucking?

The most buzz, however, is centered around apps that some have nicknamed "Uber for trucking," and this is where a lot of the new players in the trucking app space are focused.

Amazon reportedly is secretly building an 'Uber for trucking' app. And Uber apparently is getting into the act itself, with a plan to eventually tie it to its autonomous truck technology. On a panel discussion at the American Trucking Associations annual management conference last fall, Uber's Anthony Levandowski outlined a vision for the future of transportation of 'liquidity and automation.' Liquidity, he explained, is the ability to match carriers with shippers. If you're delivering people, as Uber does via its ride-sharing app, why not food, why not packages, and why not freight, he asked.

However, the 'Uber for trucking' moniker might not be the best analogy, except in terms of thinking about disruptive technologies. The ride-sharing app Uber and the trucking industry apps hoping to emulate its success address similar business problems: matching vehicles with passengers (in Uber's case) or freight. Of course, the freight market is nothing like the taxi market that Uber and similar companies, such as Lyft, have disrupted. The regulatory, contractual and other issues involved in moving freight are very different.

However, using digital tools to help match freight with trucks is gaining traction. Armstrong & Associates, a marketing and research firm specializing in third-party logistics, suggested in a 2016 report that it makes more sense to describe these products as 'digital freight matching' apps.

Whatever you call them, Armstrong reports that the segment has attracted over $180 million in venture capital funding since 2011. Armstrong looked at 27 such offerings and categorized them as:

- Uber-like: Cutting out the middleman or broker, with GPS alerts, trace and track, and automated payments

- Load board plus: Mobile app extensions of existing load boards

- Broker plus: Proprietary apps that brokers make available to their customers

- Specialty apps: Focusing on specialized freight

- Last mile: Used for e-commerce fulfillment and local delivery.

It bears noting that freight-matching services deal with spot freight. The majority of freight is moved under contract, but the spot market accounts for 15-25% of all freight, according to DAT's Harper. That number can rise due to factors such as seasonal changes or weather disruptions, he says. During the severe snow storms in the Northeast a few years ago, for instance, the spot market jumped to about 40% of freight.

A recently introduced product called Doft does bill itself as 'Uber for trucking.' The company 'is here to disrupt one of the oldest businesses in the country,' explains founder and CEO Dmitri Fedorchenko. The app matches freight with trucks, like Uber matches passengers with taxicabs, and it is designed to make these matches in less than 60 seconds.

Another company, Loadsmart, also matches loads with carriers. Diego Urrutia, the company's chief commercial officer, says the founders wanted to add more value beyond listing loads and trucks. Noting that 90% of motor carriers operate fewer than 10 trucks, the company built a free fleet management platform 'that any company can use.'

Rather than have carriers go to the load board to pick freight, 'instead we are going to push targeted business to them,' Urrutia explains. By analyzing how carriers use the service, they can streamline the process. "For the carriers on the platform, we have an idea of what they like [in terms of freight], and where they go. We are only sending them relevant business - loads they can actually pick up and want to pick up."

One of the criticisms of the digital freight matching model is that, in some ways, it represents a negative auction - the lowest rate wins. Loadsmart allows carriers to 'bid up' a load, Urrutia says. "There is an option of bidding it up or bidding it down - the carriers don't have to feel compelled to accept a load."

Trucker Path has also entered the digital load matching space with Truckloads. It is designed to connect shippers and carriers via both web-based and mobile applications. Carriers use custom searches that allow carriers to find loads that fit their specific needs. Other freight-matching startups in recent years have included Convoy, Cargo Chief, and others.

Easier said than done

But some in the industry are skeptical about the ability of outsiders to come in and understand the complexities of matching freight and trucks, despite large amounts of investor funding.

Bob Voltmann, president and CEO of the Transportation Intermediaries Association, has said publicly that these types of apps aren't going to put brokers and 3PLs out of business. There's plenty of room in the market, he contends, noting in a session at last fall's TMW/PeopleNet In.Sight user conference that the third-party logistics industry has been growing two to three times faster than GDP. The lack of commonality of truck freight means it's tough for an app to do it all, and Voltmann points out that 3PLs already are technology adopters.

Robert Nathan, CEO of Load Delivered, a 3PL that specializes in food and beverage, says such 'technology is great for our industry.' But he notes that large 3PLs and brokers have been doing this sort of thing for some time. 'If you walk around the top 100 3PLs, all of us are doing in our own way what' the new players are doing with freight matching algorithms. "If you look under the hood of an Uber for trucking app, it's the same as a pure 3PL or broker. They gave it a sexy name and suddenly their valuations [skyrocket]. These are intelligent investors who are unintelligently investing in basic brokerage."

According to Richard 'Dick' Metzler, chief marketing officer of uShip, another early online freight shipping marketplace, there's been a lot of venture capital that has poured into dozens of startups that aim to take the low-tech business of arranging cargo shipments online. Metzler, who had a long career at traditional logistics companies, such as FedEx Logistics and XPO Logistics, before moving into the high-tech marketplace, calls this the 'fear of missing out' effect, and believes most of these companies are unlikely to continue to get financing.

One early and high-profile 'Uber for trucking' entrant, Cargomatic, launched in 2014, and in early 2015 announced $8 million in investor funding to help it expand its platform. But by September of last year, published reports indicated that the company was struggling, with the departure of key executives and insiders saying the company was running out of cash. (Cargomatic did not respond to our request for an update.)

Beyond the freight

A number of apps aim to do more than just match loads and freight. For instance, SmartTruckRoute, a mobile GPS app, combines truck routing and mapping with the Trulos Load Board. Targeted at owner-operators, the app shows truckers available loads along their current route or a future route they've mapped out on the system. The company says the app helps simplify obtaining backhauls, full or partial loads.

FreightRover, a recently introduced app, is designed to 'connect carriers in a more efficient manner with their owner-operators,' says Michael Pecchia, FreightRover CEO. The company found that being able to pick their own route was a major 'sticking point' with owner-operators. The FreightRover app allows each owner-operator to self-dispatch.

In a sense, it is similar to a load board, he says, but the app eliminates any phone calls the driver might have to make. 'We do that automatically.' The app also features track and trace and geofencing functions. They began testing the app last April with a 30-truck unit at Indianapolis-based truckload fleet Celadon. In July, it was opened to all Celadon owner-operators.

Pecchia says driver performance has improved with the app, such as a 1% increase in on-time percentage. Plus, the app relieves some of the pressure from dispatch. It interfaces with the company's TMS software so dispatchers receive updates on loads, but they don't have to assign those loads - they only need to deal with the exceptions.

The company is working on an open model, probably four to six months away, that will let them solicit loads directly from shippers and post them like a load board so drivers can pick the loads they need. Under this app, shippers control who sees their loads. "Only their favorite carriers can see those loads, or they can open up to all carriers," Pecchia explains. FreightRover's goal is to connect everyone through one portal - carriers, shippers, and drivers.

The sheer number of mobile apps available for trucking can be overwhelming. But not to worry. According to the analysts at Frost & Sullivan, consolidation within this space is inevitable, with some companies acquiring others, and established vendors forging partnerships with new entrants - or new entrants working with fleets such as Celadon and U.S. Xpress.

Whether from a new startup or a long-time provider, in trucking there is definitely 'an app for that.'

Editor in Chief Deborah Lockridge contributed to this story.

By Jim Beach

Source: HDT Truckinginfo